通过联邦快速通道 EE 去申请枫叶卡是个快速,一步到位的选择。 但多数申请者分数不够,无法被移民局抽出来。 也有些申请者在网上计算了自己的分数,发现太低,然后干脆就不入 EE 池子。

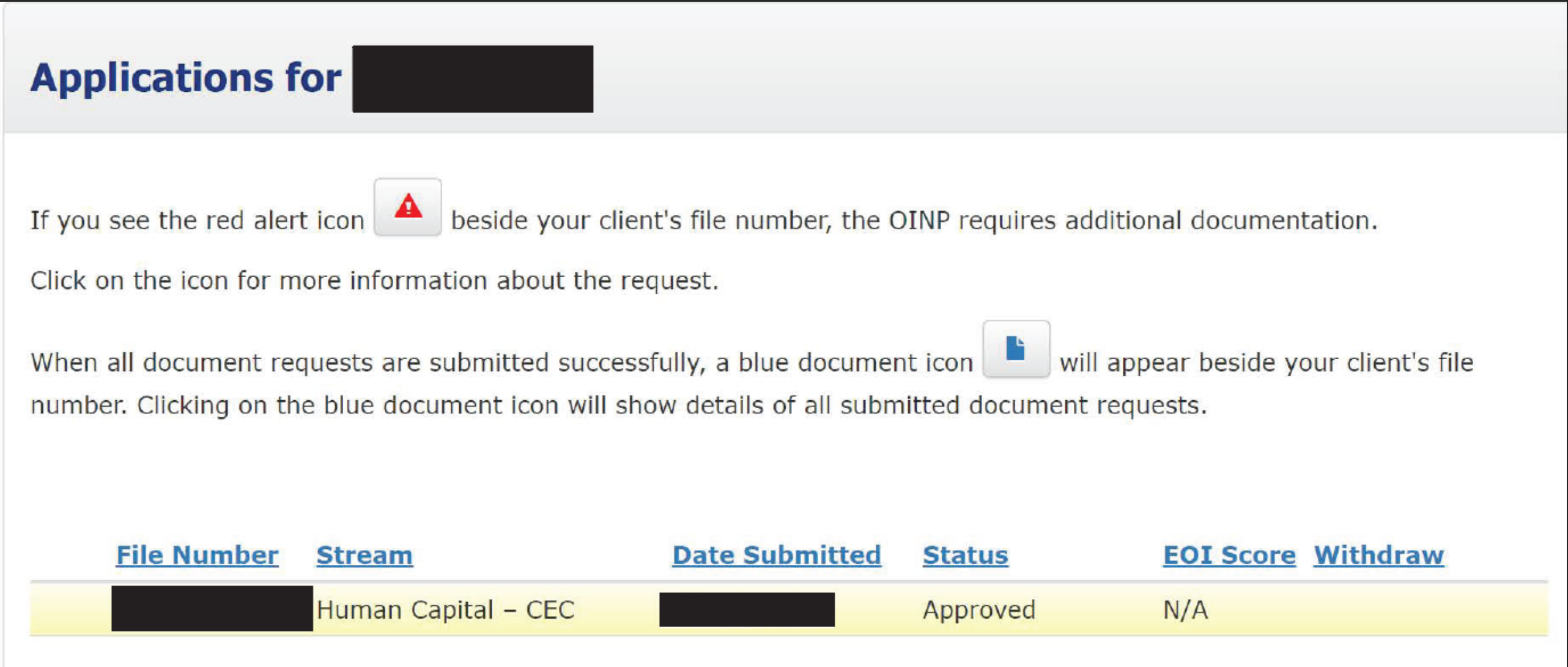

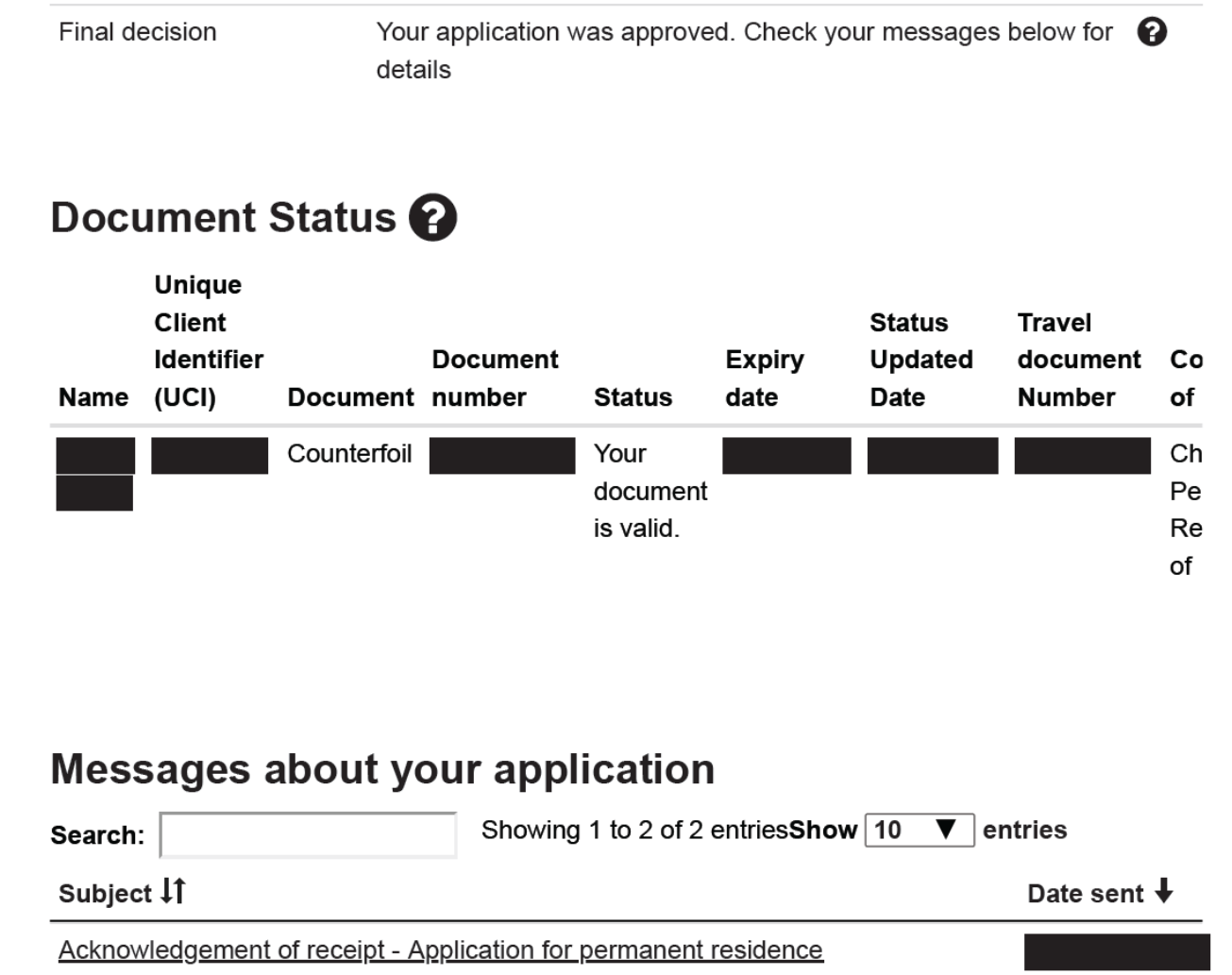

我们给客户的建议是,就算分数低,还是尽早入 EE 池比较好。 原因是安省会经常邀请池子里的申请者去申请安省优先人力项目 – 如果通过,申请者会多拿600分 – 那就肯定会被 EE 池抽出 – 之后就可以申请获得枫叶卡。

其中 要注意的是,不要为了给自己加分而提供模糊或没有文件证明的信息。比如,如果在池子里说自己有多伦多大学本科学位,那就必须得有多伦多大学的毕业证书。如果说自己有语言成绩,工作经验 – 那被邀请后就必须提供IELTS 或 CELPIP 成绩单,以及雇主信和工资单。 如果无法提供文件,或者文件跟当时 EE 输入的信息不同,那移民局肯定会拒绝枫叶卡申请,最糟糕还可能不让申请者在后面几年内再次申请。

我们有个客户是约克大学本科毕业,商业系,然后有一年的本地工作经验做宣传。他在池子里总是差个 300分左右,但我们还是建议他提早入池子。结果,他幸运的被安省邀请,我们帮他通过了安省申请,加了600分。他立刻被联邦池子抽出,然后我们成功的帮他获得了枫叶卡。 他高兴,我们更高兴。